Your Cart is Empty

⭐️⭐️⭐️⭐️⭐️ 7000+ Reviews | 30-Day Warranty | Secure Payments

⭐️⭐️⭐️⭐️⭐️ 7000+ Reviews | 30-Day Warranty | Secure Payments

How To Budget Your Finances Using Your Bullet Journal

August 15, 2022 2 min read 1 Comment

Budgeting is a tricky subject. It's easy to feel overwhelmed by the idea of creating a budget, but it's also one of the most important things you can do for yourself.

There are plenty of ways to keep track of your spending, but we think a bullet journal is the best way. We're not just saying that because we're huge fans of bullet journals; we're saying it because they allow you to be more flexible and creative when budgeting.

The most important thing when budgeting is to be consistent. Use the same system each month, and try not to change it up too much. The more consistent you are with it, the more accurate it will be!

Here’s how you can do it:

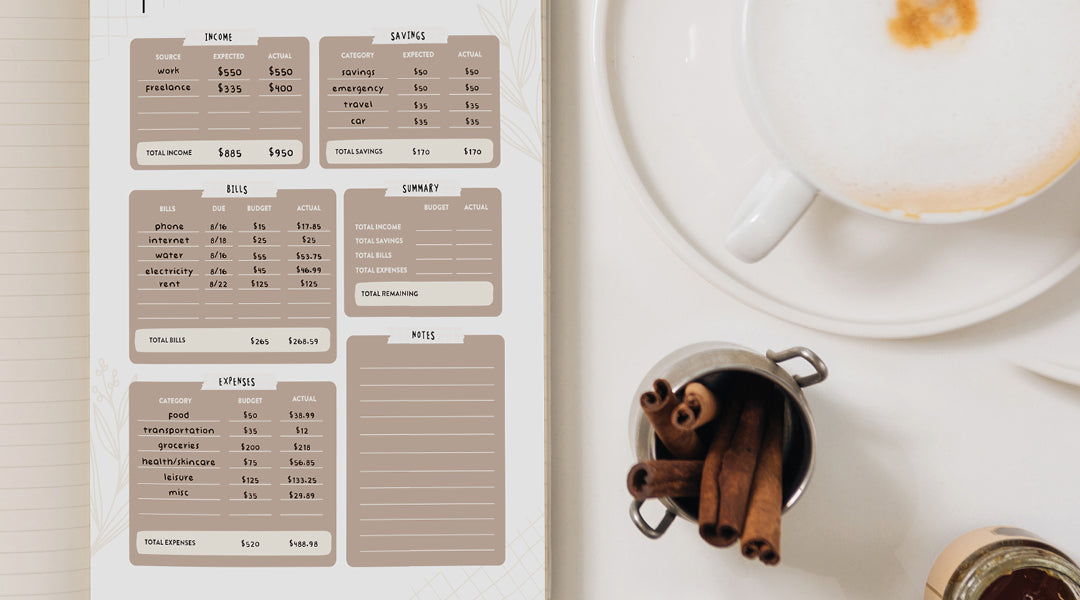

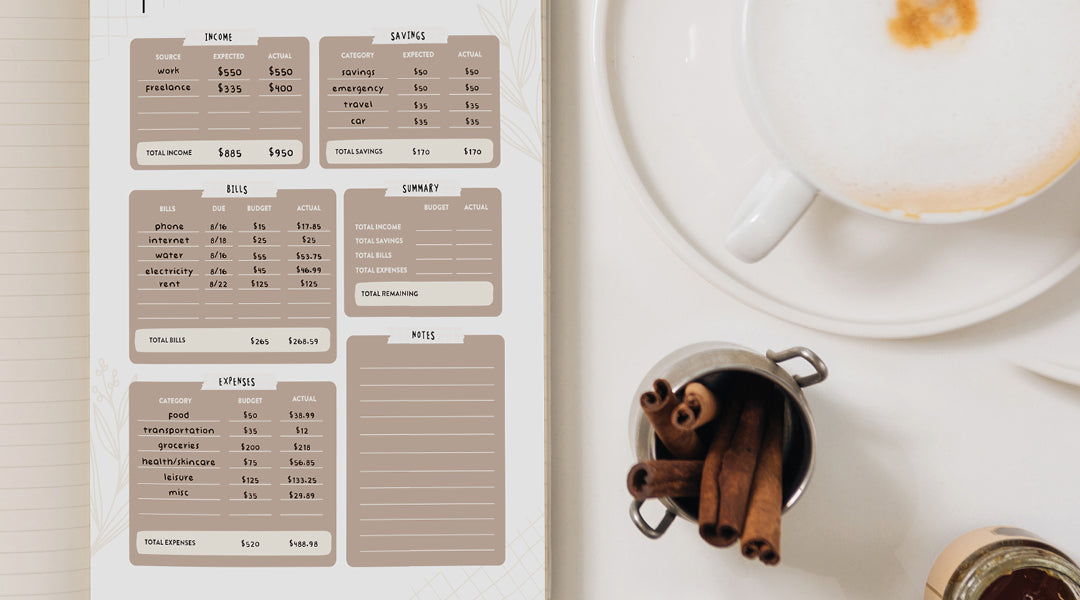

You can start by writing down your income and side income (if you have any) for the month at the top of the page. Write it down as soon as it happens so you don't have to rely on your memory or keep track of receipts if you lose them.

Create a column for your savings and emergency funds. If this is new to you, start small—maybe just 5% of your income each month. As time goes on, increase it until you're saving enough for an emergency fund (and more).

Next, create another column for bills and other expenses that need to be paid regularly. Add in any other expenses that come up throughout the month—like birthdays or anniversaries—and make sure to note down when they are due so that they don't sneak up on you.

Record all of your expenses, by listing them down, as they come up so that you can see where the money goes. This can be done with either a single column or multiple columns on one page—it's up to you! Just make sure that it's easy enough for you to fill out quickly so that things don't fall through the cracks when it comes time to review them later on.

Finally, once all of your expenses and savings have been recorded, take time each month or quarter to review them against your income so that you can see if there are any areas where you need improvement. Once you've got a good idea of how much money comes in each month and how much goes out, you can start making plans for how much more cash flow is needed (or wanted)—and then figure out which areas of spending are most important so they stay funded while other areas get cut down or eliminated altogether.

We hope that this will help you set realistic goals and create a budget that works for YOU.

There are plenty of ways to keep track of your spending, but we think a bullet journal is the best way. We're not just saying that because we're huge fans of bullet journals; we're saying it because they allow you to be more flexible and creative when budgeting.

The most important thing when budgeting is to be consistent. Use the same system each month, and try not to change it up too much. The more consistent you are with it, the more accurate it will be!

Here’s how you can do it:

You can start by writing down your income and side income (if you have any) for the month at the top of the page. Write it down as soon as it happens so you don't have to rely on your memory or keep track of receipts if you lose them.

Create a column for your savings and emergency funds. If this is new to you, start small—maybe just 5% of your income each month. As time goes on, increase it until you're saving enough for an emergency fund (and more).

Next, create another column for bills and other expenses that need to be paid regularly. Add in any other expenses that come up throughout the month—like birthdays or anniversaries—and make sure to note down when they are due so that they don't sneak up on you.

Record all of your expenses, by listing them down, as they come up so that you can see where the money goes. This can be done with either a single column or multiple columns on one page—it's up to you! Just make sure that it's easy enough for you to fill out quickly so that things don't fall through the cracks when it comes time to review them later on.

Finally, once all of your expenses and savings have been recorded, take time each month or quarter to review them against your income so that you can see if there are any areas where you need improvement. Once you've got a good idea of how much money comes in each month and how much goes out, you can start making plans for how much more cash flow is needed (or wanted)—and then figure out which areas of spending are most important so they stay funded while other areas get cut down or eliminated altogether.

We hope that this will help you set realistic goals and create a budget that works for YOU.

Don’t know how to start your layout? No worries! We created a free printable budget tracker that you can use or easily cut and stick to your bullet journal!

Did you find this article helpful? Let us know in the comments! Share it with your friends using the social share buttons below.

1 Response

Leave a comment

Comments will be approved before showing up.

Artist Feature: The Transformative Power of Art with Mary Jo Davis

June 06, 2024 4 min read

Art has always been associated with glamour, aesthetic allure, and perfection.

Each brush stroke or penmark is done in pursuit of an ideal.

However, amid this facade, there exists a perspective that transcends the superficial perspective of art.

Mary Jo Davis (@maryjokovarikdavis) sees art beyond the glitz and glamour.

For her, art is an avenue to express the depth of her emotions or better yet, her reality.

Artist Spotlight: Find Yourself through Art with Emily

May 15, 2024 4 min read

In this month’s feature, we’re excited to spotlight Emily (@emilyydianeart), an artist whose deep connection with art has been a guiding light through life’s darkest moments.

Read More Recent Articles

- FOTM: August Free Printable Planner and Sticker Pack

- Artist Feature: The Transformative Power of Art with Mary Jo Davis

- Artist Spotlight: Find Yourself through Art with Emily

- FOTM: April 2024 Free Printable Stickers and Habit Tracker

- How to Draw a Sunflower: A Step-by-Step Guide for Beginners

- FOTM: January 2024 Free Printable Stickers and Resolution Tracker

- FOTM: December Free Printable Christmas Tags

- 5 Easy Art Exercises for a Healthier Mind

- FOTM: November Free Printable Sticker Pack

- How To Create a PSL Ingredient Spread

Categories

Don’t miss out on the good stuff!

Want cool free stuff like this free Cosy Woodland Bujo Kit Printables?

Sign up to our newsletter to claim yours and get regular access to freebies!

Sarah

December 14, 2022

Thanks so much,this budget idea for my finances will be of great help.

I will keep you posted on how it benefits me in the next few months.